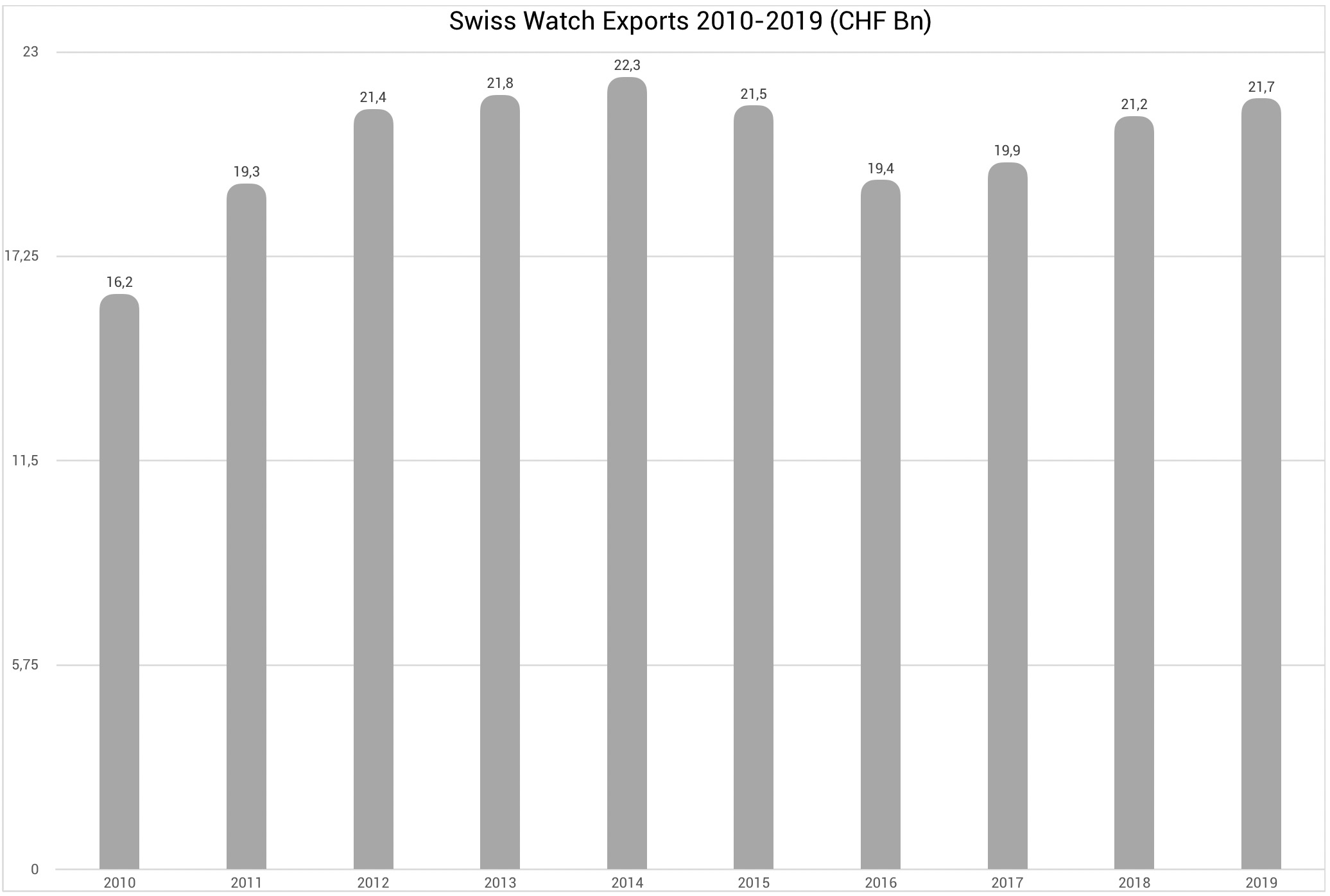

The FHS (Federation Horlogère Suisse or the Swiss Watch Federation) just released the export statistics for 2019. Swiss watch exports showed growth in December (+5.8% at CHF 1.7 billion). For the whole year 2019, exports rose by 2.4% in value at CHF 21.681 billion, however, the units shipped dropped by 13.1% at 20.634 million and the outlook remains quite uncertain for 2020. If figures have now climbed for the third consecutive year, the performance achieved is still inferior to that of 2014.

Exports across geographics

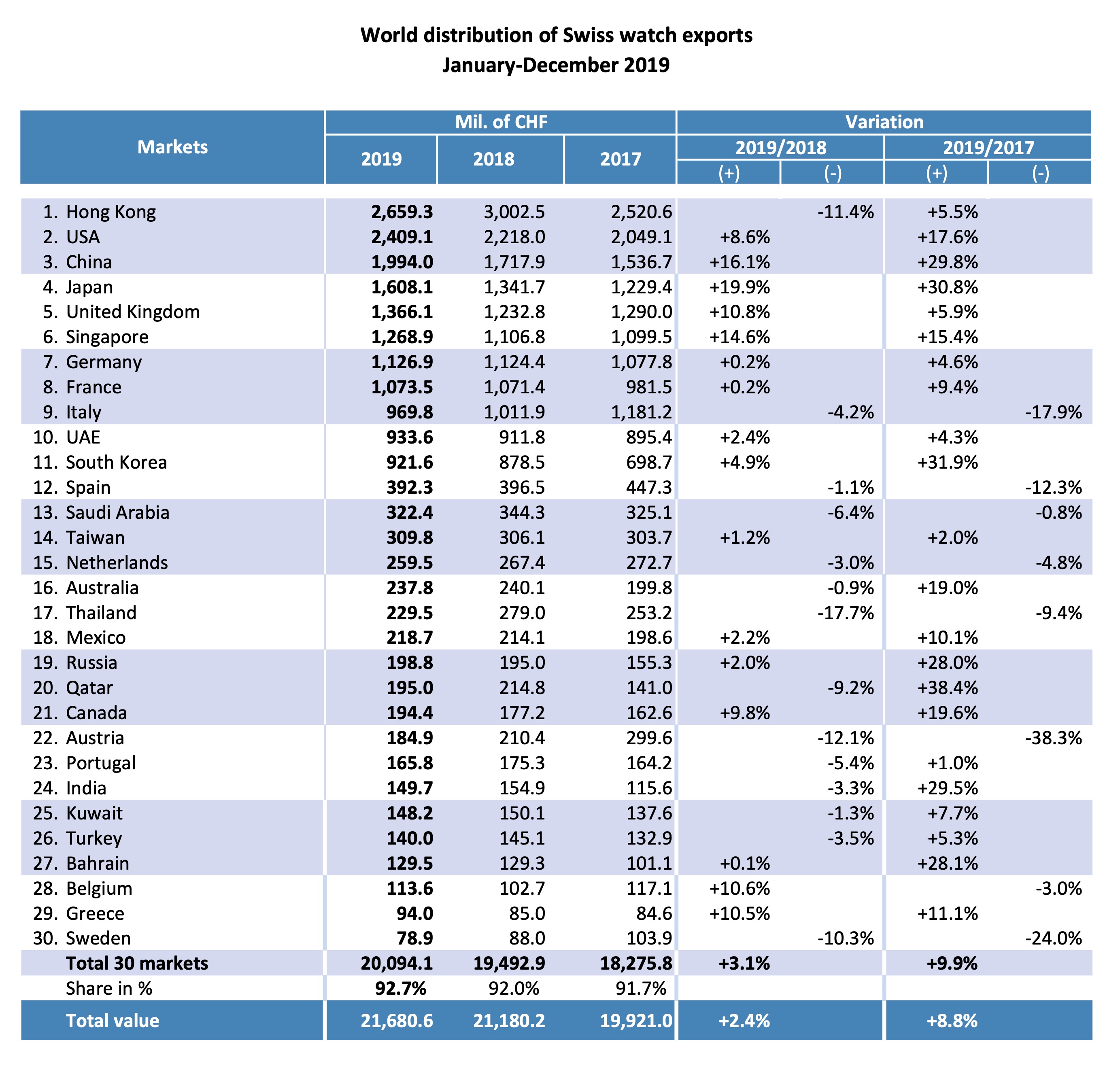

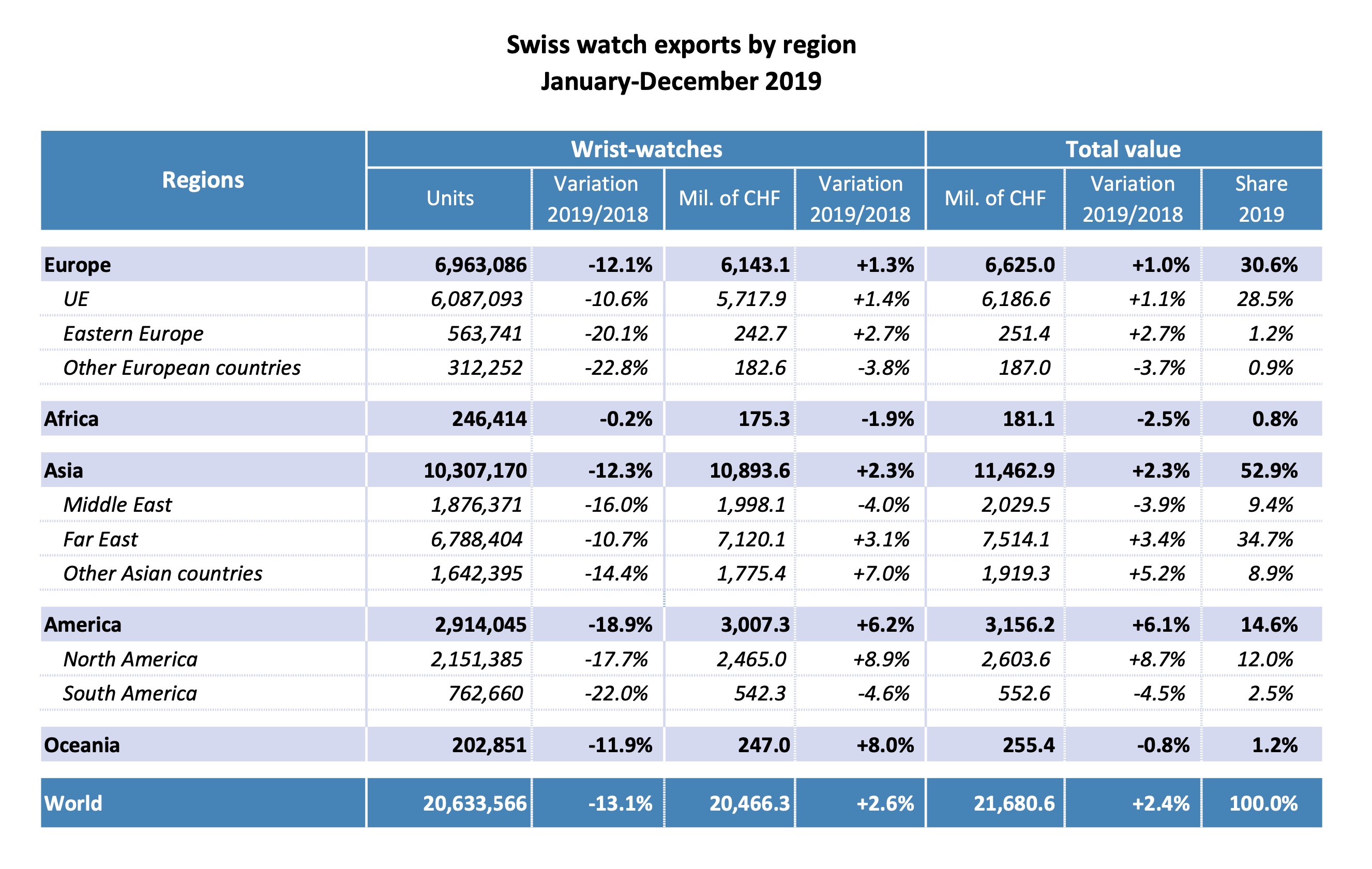

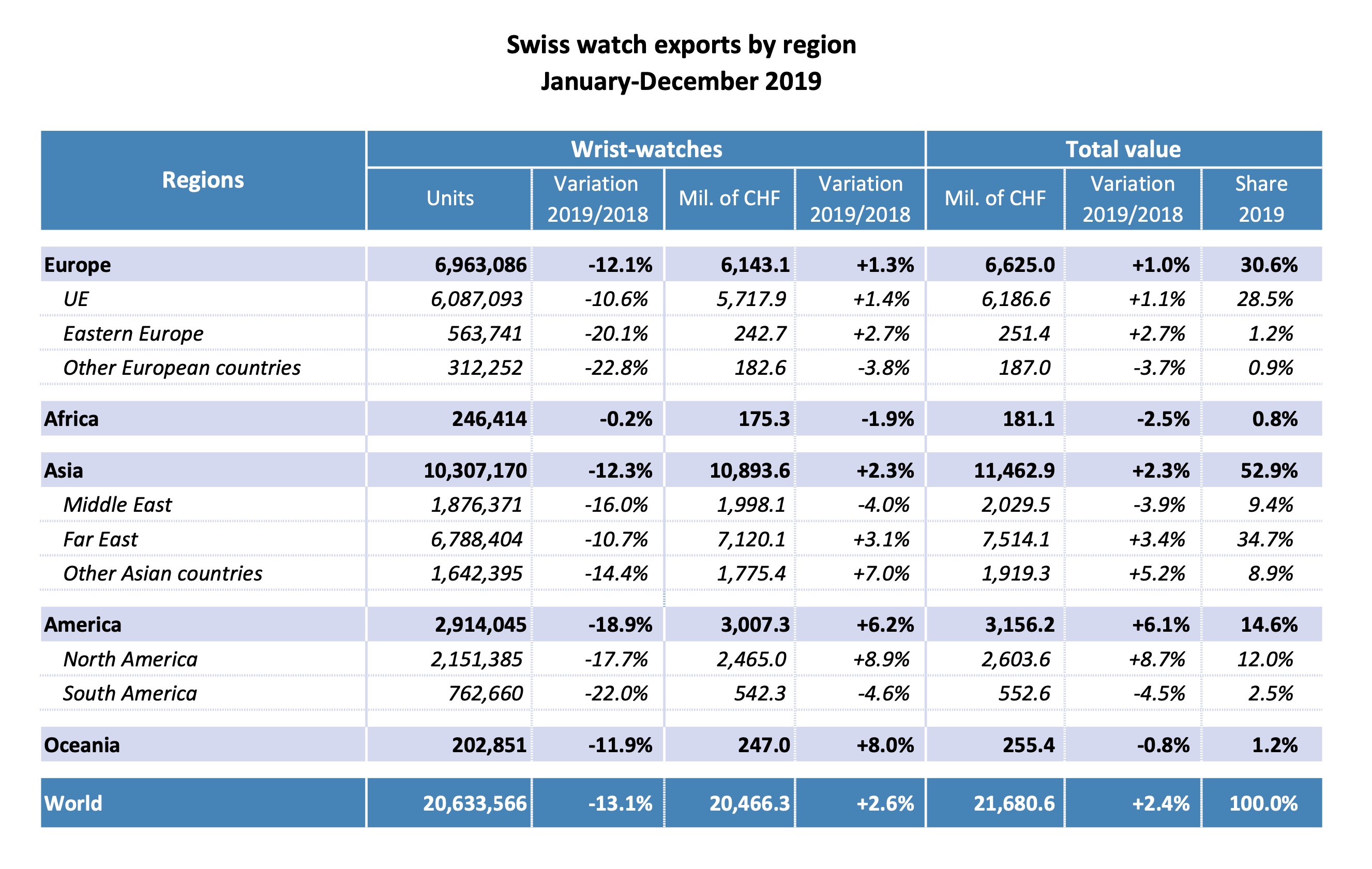

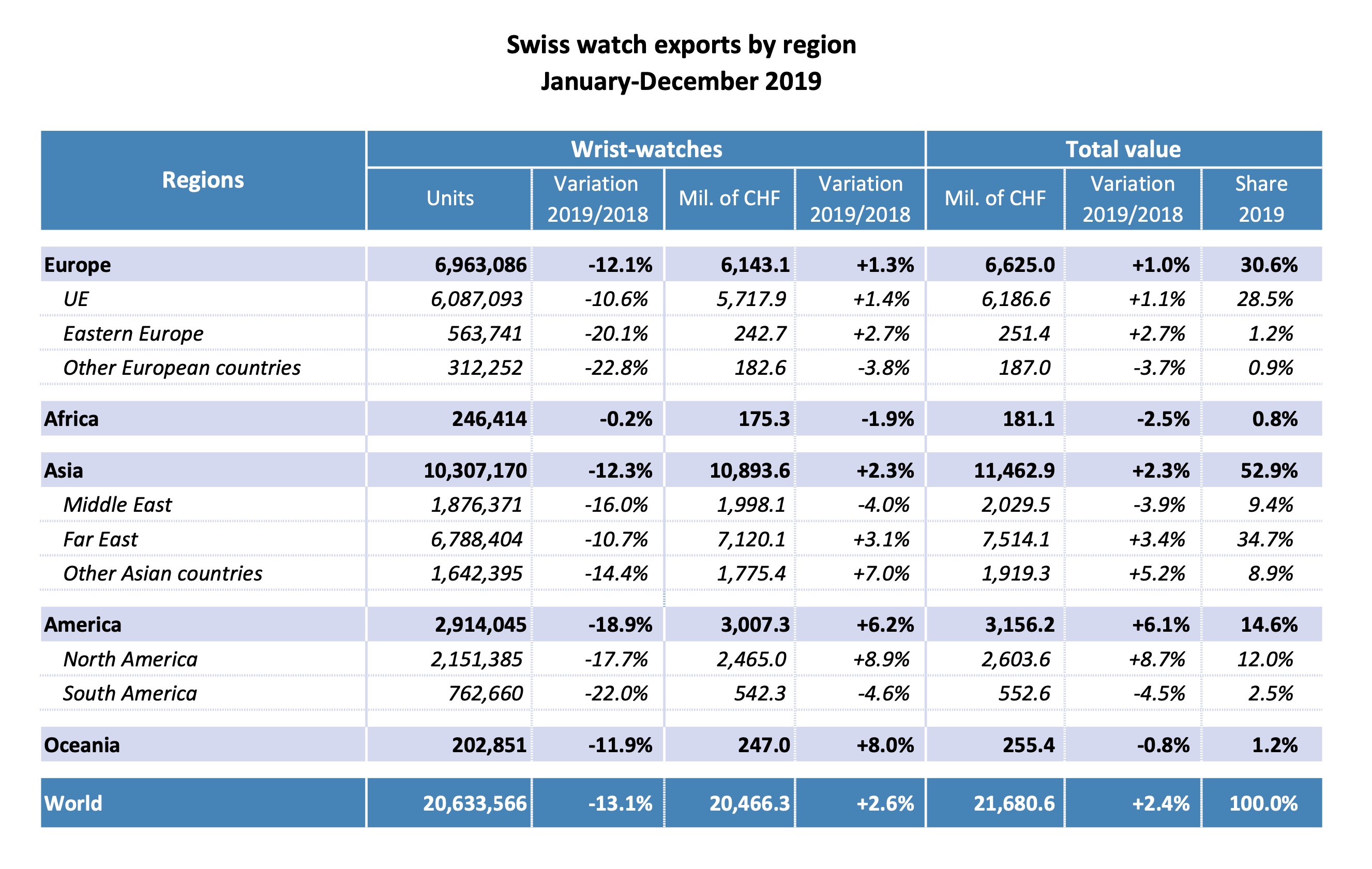

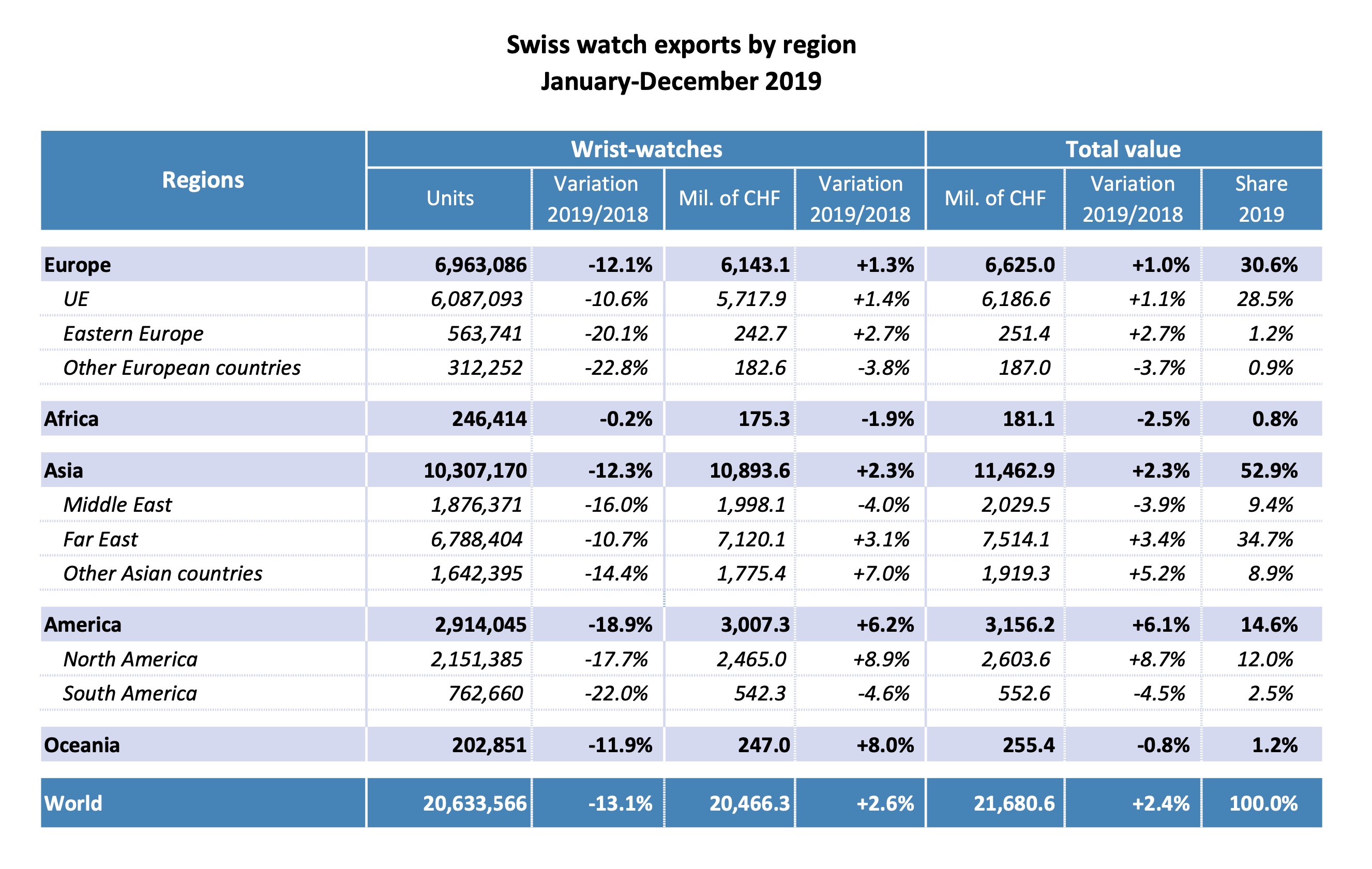

Despite the complex situation in Hong Kong, exports to Asia rose by 2.3%. Asia remains the main destination for Swiss watch exports with 52.9% of the total value. The increase in China (+16.1%), Japan (+19.9%) and Singapore (+14.6%) in particular helped offset the marked contraction in Hong Kong (-11.4%). The sales to the Middle East were down (- 3.9%).

Swiss watch exports to Europe were broadly in line with the prior year (+1.3%), yet with marked disparities between the main countries. The trend was notably good for the UK (+10.8%), which is still the first European destination for Swiss watches, followed by German and France, both with flat numbers compared to 2018. In total, Europe accounts for 30% of Swiss watch exports.

The trend was good for the Americas, in particular for the United States (+8.6%). Exports to South America were down 4.5%. Overall, despite the contraction in Hong Kong, which accounts for over 12% of the Swiss watch exports, the good performances of other important markers (USA, China, Japan and UK) managed to keep exports on the rise for 2019.

Exports by Products

As usual, exports of wristwatches dictated the general trend. Their value reached CHF 20.466 billion (for a total market of CHF 21.680 billion), with a positive trend up 2.6%. However, noticeable is the decline in units shipped. The number of timepieces exported felt to 20.634 million pieces (-13.1%). If the quantity of mechanical watches exported is slightly down (7.235 million, at -3.9%), the trend remains very negative for Swiss Made electronic watches (13.398 million, at -17.4%). Over the past 5 years, the number of electronic watches exported dropped by 34.5%. Exports of movements were down 10.2% in units, at 4.444 million.

Overall, if the high-end Swiss watches remain attractive and have enjoyed continuous growth, the low/mid-end segments have been under pressure for several years. In particular, the smartwatch expansion seems to come at the expense of the lower-priced Swiss timepieces. Apple sold more watches than the entire Swiss watch industry (with estimated sales of around 30 million Apple watches sold in 2019).

For more information, please visit www.fhs.swiss. Graphics in this article to be credited to the FHS.