CAD and PLM software specialist PTC (PTC) picked an interesting time to convert to a growth company, as weak PMIs across the globe don’t really bode well for sales to industrial and auto companies. Even so, the company has been rebuilding credibility with some solid quarters, and I remain bullish on the potential in leveraging IoT partnerships with Microsoft (MSFT) and Rockwell (ROK), as well as leveraging growing interest in IoT and augmented reality (or AR) as invaluable tools within a range of end-markets.

These shares have shot up almost 30% from my last article, helped by a strong reaction to fiscal first quarter earnings (a clean quarter with some guidance upside). Although the stock isn’t so compelling anymore from a FCF/DCF perspective, I still see some multiple-driven upside and I think annualized recurring revenue (or ARR) growth will be the driving factor in how the stock performs in the near term.

Strong Results Against A Challenging Backdrop

That PTC managed to beat expectations for revenue, ARR, and margins in a quarter where industrial companies were still quite cautious with spending is a solid testament to the underlying momentum here.

Revenue rose 6%, beating expectations by about 4%, with strong growth in new subscriptions (up 80%) and subscription support (up 26%). Gross margin declined 160bp from the year-ago period, but still came in about as expected. Operating income rose 2% as reported (and 14% qoq), and the operating margin beat by more than three points, but the wide spread of estimates (due, I believe the analysts dialing in the new accounting policies) mitigates the significance of that beat.

In terms of what I believe really matters for most investors now, growth in ARR, PTC did rather well. ARR rose 11% in constant currency, beating expectations by almost 4% with 10% growth in the core business and 36% in the “growth” business. Management did modestly raise its full-year guidance for ARR, though about three-quarters of that was due to foreign exchange effects.

Within the core, management reported mid-teens constant currency growth in the PLM business, with strong results in China and Europe despite ongoing macro weakness there. With PLM systems increasingly serving as the backbone for industrial digitalization, it would seem that this is a priority spending item – good for PTC, as well as Dassault (OTCPK:DASTY) and Siemens (OTCPK:SIEGY). By extension, though, the CAD business did not fare as well this quarter.

Within the growth segment, management said that AR grew above market growth, and that 65% of bookings for IoT and AR were expansion bookings .

ASC 606 Will Create Some Variability

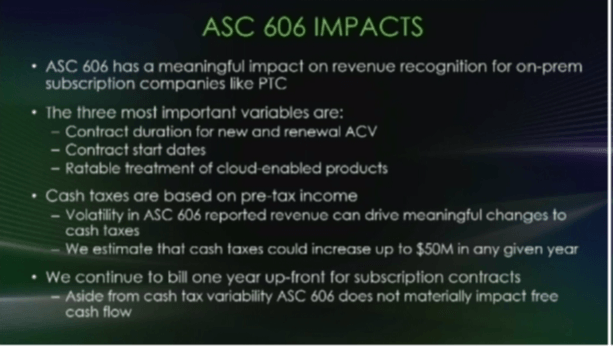

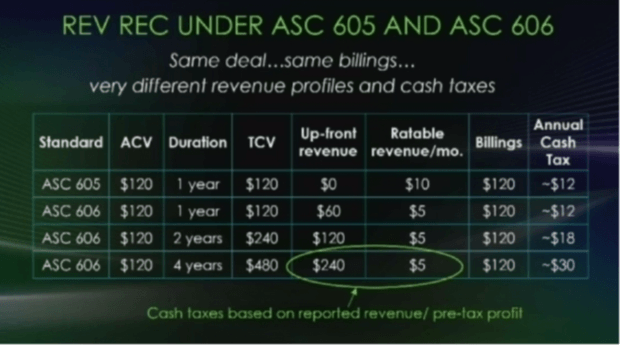

PTC management has done a good job in my opinion of trying to walk analysts and investors through the switch to ASC 606 and the impact it will have on reported financials going forward. The biggest takeaway is that it will lead to greater variability in year-to-year P&L results, with variability tied to contract durations, contract start dates, and ratable treatment of cloud products. From a cash flow perspective, the biggest impact is likely to be in significant year-to-year variability in cash taxes.

The following slides from a company presentation may be of some help in understanding how ASC 606 can impact reporting.

source: PTC company presentation

Shifting From Margins To Growth

The biggest theme and takeaway from PTC’s late November investor meeting was that PTC management clearly sees the company pivoting away from a margin focus to a growth focus. That doesn’t mean that margins are going to crater and the company is going to spend recklessly. Instead, it has more to do with PTC prioritizing the maximization of the growth opportunities in areas like PLM, IoT, AR, and SaaS-based CAD (the Onshape acquisition).

IoT is only just getting started in the industrial space, but PTC has already seen significant deals come for smart connected products through its Microsoft partnership, and the Rockwell partnership gives PTC exposure to a much larger footprint of potential smart connected operations clients. As a reminder, it is platforms like ThingWorx that will drive this. ThingWorx provides a range of IoT-enabling functions, including quicker/easier connectivity (adding IoT devices to a network), data management and analysis, app development, and system/device/network management and orchestration.

At that meeting, management reiterated some attractive growth targets for the business, including high single-digit growth potential in CAD/PLM, 26% growth from IoT, and 60% growth from AR. Just as IoT is in its very early days in the industrial setting, augmented reality has barely even started, and I believe this will prove to be an invaluable tool across a range of industries for training, design, and sales/marketing functions.

The Outlook

One negative development since my last update on the company is the news that PTC’s EVP of Field Operations left to become CRO at CyberArk (CYBR). It will be a loss for the company, but they have replaced him internally (elevating two executives), and PTC did not lose him to a rival.

I thought that PTC needed a few clean quarters to shift sentiment, but it looks like sentiment has already shifted pretty significantly. Even so, I believe PTC is looking at a meaningful growth acceleration from here. I expect high teens growth in fiscal 2020 to moderate some, but I believe PTC can generate low-to-mid teens revenue growth over the next five years and low double-digit growth over the next 10 years. I believe this growth will also be increasingly lucrative for the company, driving adjusted FCF margins into the 30%’s over time.

While the shares are no longer undervalued on a DCF basis (I estimate a high single-digit annualized potential return unless PTC can drive even better growth), there is still some upside on a multiple basis; looking at what the markets have historically paid for similar combinations of revenue growth and margins, I believe there’s upside into the $90’s, though investors should note the shortfalls in ARR or margins will be harshly punished the further the shares stray from what I’d call a “core” FCF-based fair value.

The Bottom Line

As a facilitator of industrial digitalization and automation, I believe PTC is in the early innings of transformative growth. There’s no shortage of competition, and both industrial IoT and AR may fall short of robust adoption expectations today, but I’m not all that bothered by those risks. PTC is more of a growth/momentum stock now, but still one that I think has some upside and some appeal. And for those disinclined to pay up for growth, I’d at least suggest putting this name on your watchlist to take advantage of any pullbacks or wobbles.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.