Saving money is something that most people struggle to do. Recent studies have shown that 40% of Americans don’t have enough money to cover a $400 emergency and only 39% have enough money saved for a $1,000 emergency. No matter how much you make or how secure your overall finances may be, most people could use some extra help and inspiration to save money.

Saving money doesn’t just “happen.” One of the best strategies to save money is to make it automatic. When you automate your savings, you are more likely to make saving a consistent priority and see your savings grow.

There are a few key methods that you can use to automate your savings.

Save Money From Every Paycheck

A classic saying in personal finance is “pay yourself first.” Before your paycheck hits your bank account, you should set up a plan to put some of that money into a retirement savings plan or cash savings account. You can’t spend it if you’ve already saved it.

One of the best ways to save automatically is to enroll in your employer’s tax-advantaged retirement plan, such as a 401(k) or 403(b) plan. Depending on the rules and limits of your retirement plan, you may be able to save a percentage of your salary and your employer will match your contributions, up to a certain percentage.

For example, you might get an employer match of 50% of the first 5% of your salary that you save for retirement. This is essentially “free money.” If you aren’t enrolled in your company’s 401(k), you could be missing out on thousands of dollars per year in employer matching funds, not to mention the long-term growth potential and the immediate tax savings.

If your company does not offer a tax-advantaged retirement plan, you can still save money for retirement on your own by setting up an individual retirement account (IRA), Roth IRA, SEP IRA (if you’re self-employed) or other retirement savings account. Make your savings automatic by setting up recurring deposits from your checking account.

Most banks let you set up automatic deposits from your checking account to your savings account. You can make these deposits monthly and have them continue for a certain number of deposits or for as long as you want into the future.

Use Automatic Savings Tools

In the past few years, a variety of new apps and savings tools have come onto the market to offer people innovative ways to save money. Some of these tools, known as round-up apps, let people automatically save their spare change by “rounding up” the amounts from everyday purchases. For example, if you spend $5.25 at a coffee shop, the app will automatically transfer 75 cents into your savings account.

Many of these apps offer a variety of financial solutions and account types to help people with short-term and long-term savings goals. During 2018, consumers used fintech tools like Acorns and Stash to save nearly $5.6 billion.

If you’ve ever wanted to make savings happen without having to think about it, you might want to try one (or more) of these apps. Or if you’ve ever worried that you can’t “afford” to save because it would take away too much cash from your everyday life, check out Digit. It analyzes your spending patterns with AI and then automatically saves money for you, without your having to make decisions.

Don’t Just Cut Your Spending—Boost Your Savings

There are plenty of budgeting tools and apps to help people analyze their spending, and that’s great. There’s nothing wrong with figuring out where your money is going. But, once you decide to make some cuts to your monthly spending, it’s also important that you actually follow through with saving that money. Otherwise, seeing extra money in your checking account, you might just spend it somewhere else.

For example, if you decide to cancel your gym membership that you haven’t been using, once that monthly $100 fee is no longer being deducted from your checking account, you should set up an automatic $100 deposit (on the same day each month) into your savings account.

If you pay off your car loan, and all of a sudden have an “extra” $300 a month, set up an automatic recurring savings deposit on the same day that your car loan used to be due.

If you cancel a few monthly subscriptions and find you have an extra $50 that you’re not spending, schedule a recurring deposit and put it into savings. Turning your monthly expenses into monthly deposits into your savings account—even in seemingly small amounts—can help you build big momentum toward your savings goals.

What if you could cancel an underused gym membership and cut back on a few monthly app subscriptions like Netflix, HBO NOW, Hulu, Spotify or other streaming content services that you’re not using often enough? If you could find an extra $150 a month of these types of unwanted expenses, after a year you’d have an extra $1,800 in your savings account.

Cutting spending is good. Making sure you actually put that money into savings is even better.

Track Your Savings Progress

There also are plenty of tools available to track your progress in paying off debt. It’s not always as easy to find tools to track your progress toward savings goals—other than checking your account balances, of course.

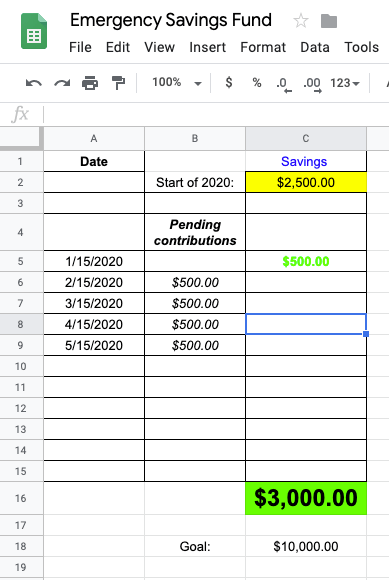

One tool that I like to use for my savings goals is something simple yet customized: a spreadsheet. Set up an Excel file or Google sheet with three columns: Date, Pending Contributions and Savings. Every time you transfer money to your savings account, you move the number from the “Pending” column to the “Savings” column.

In the example spreadsheet shown here, the saver has started 2020 with a savings balance of $2,500 and has set up a series of monthly recurring contributions of $500 per month. They have a current savings account balance of $3,000 and are trying to reach the goal of $10,000 in their emergency savings fund. At their current rate of savings, they are 14 months away from reaching their $10,000 goal.

Of course, you can customize your own spreadsheet to fit whatever goals and amounts are relevant to you. You can set up as many recurring deposits as you want, and then watch your savings goal get closer.

Whatever method you use to track your savings, getting visibility into your savings plan can help make it more real to you. Making your savings automatic, and then tracking results, can be a surprisingly fun and reassuring experience.

Making More Money? Save More, Too

Have you recently gotten a pay raise? Make sure you are increasing your savings to adjust to the higher income.

One way to boost your savings automatically, depending on which features are available in your retirement savings plan, is to use a contribution rate escalator. This is a savings tool that some 401(k) plans offer that lets you automatically raise the percentage of money that you are saving for retirement each year, until you reach a target percentage.

For example, if you are already saving 5% of your income in your 401(k), a contribution rate escalator would let you automatically increase that percentage by 1% of your income per year until you were saving up to 10% or 15% or whatever savings goal you wanted to set.

Increasing your savings is especially important if you have just received a big boost in pay. If your income has significantly increased, this is a great opportunity to save more money for retirement, increase your emergency savings, save for your children’s college education or put money toward other savings goals.

Manage Windfalls Wisely

What if you’ve received a one-time financial windfall, such as a large bonus, an inheritance, proceeds from the sale of a home or business or other big financial gain? It might be tempting to splurge on a major purchase, take an expensive vacation or reinvest that money in a hot investment opportunity. Depending on the size of the windfall and your overall financial situation, however, you’ll often be better off taking some time to evaluate your options.

Start by putting the money in a high-yield savings account. Talk to a financial advisor if you have concerns about the tax implications of your windfall, or want to make the most tax-efficient decisions about how to invest the money. Plan for how to use this money not just as a one-time infusion of cash, but as part of a longer-term strategy for financial security for the rest of your life.

Unless you win the lottery or cash out your shares of a wildly successful startup, for most people, saving money doesn’t just “happen” and it definitely doesn’t happen overnight. Some of the most successful savers are able to save because they make it automatic. With steady, ongoing contributions to retirement plans and recurring deposits into cash savings accounts—and with frugality, discipline, smart investment decisions and a bit of luck along the way—it’s possible to create your own safety net of financial security.

Perhaps the biggest secret to making your savings automatic is making saving fun. People often assume that “saving money” means deprivation and joylessness, and that “spending money” is exciting and therapeutic. But saving money can improve your mood, too.

One of the most surprising benefits of automating your savings is seeing how it can improve the way you feel. When you know how much money is going into savings each month, and when you are able to watch your savings grow, you will hopefully feel greater peace, confidence and control over your life.