The dry bulk market is reeling under pressure in the aftermath of the coronavirus outbreak. With the most affected area in China, being predominantly a steel producing region, demand for iron ore has plunged.

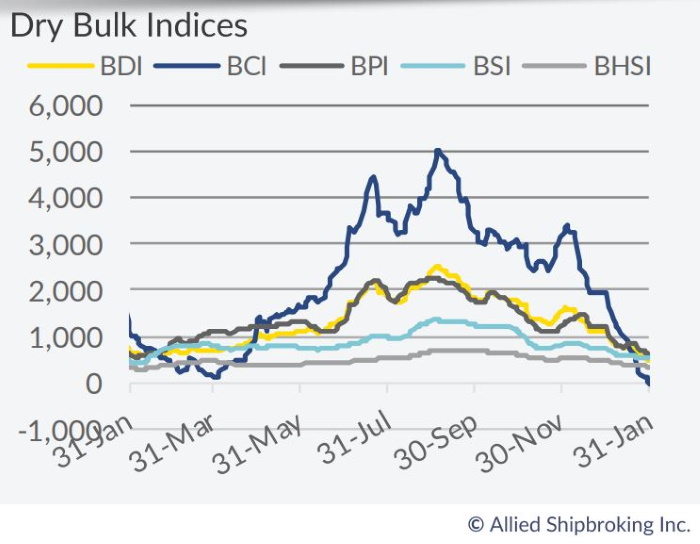

Additionally, freight rates have plunged as a result of the trade halt, both towards and out of China, due to the quarantine measures. In its latest weekly report, shipbroker Allied Shipbroking noted that “the recent slump in the dry bulk freight market may well have been expected to some degree, but despite this the shock was still overwhelming when the BCI reached for the first time in its history a negative figure (-20 bp on Friday with even lower figures being posted today). At the same time the average earnings per day fell beneath the USD 4,000/day, a level considerably below even the most conservative OPEX levels. Significant losses were also being noted across the rest of the dry bulk size classes”.

According to Mr. Yiannis Vamvakas, Research Analyst with Allied, “the key driver behind this downward spiral couldn’t be other than China, the Asian giant that encompasses approximately 12.5% of global trade. The recent Novel coronavirus (2019-nCoV) outbreak seems to have brought about another stall in the global economy. The aftermath of the virus outbreak has been severe so far, with the Chinese stock market having posted its worst opening since 2007, while several multinational and local companies have temporarily shut down operations in the country, amongst them, construction sites and steel production facilities. Given that the main affected regions produce approximately 60% of the total steel production within the country, it is of little surprise that demand for iron ore has been limited as of late”.

Allied’s analyst added that “it is worth mentioning that last year it is estimated that China produced about 1 billion tons of steel, while consumed more than 1.5 billion tons of iron ore. The impact of this halt in operations is also depicted in the price of iron ore, that has dropped significantly during this past week, as well as the losses that have been witnessed in the stock prices of key iron ore traders such as Vale, Rio Tinto and BHP. The situation in China has not been the only headache for iron ore traders, as severe floods noted in southeastern Brazil last week, a key iron ore producing region, has reduced Brazilian exports, limiting the availability of cargoes and further limiting activity in the Capesize sector”.

“Meanwhile, official numbers are showing an expectation for less iron ore cargoes to be exported from Brazil in 2020 compared to 2019. China’s importance is not limited to the iron ore trade, being a key player in the whole global trading ecosystem. Imports for agricultural products as well as coal have also been reduced, as the barriers to free movement of people has limited the ability of the Chinese economy to operate smoothly. In the US, there are concerns regarding the recent trade deal that was signed between Washington and Beijing. The food safety concerns as part of the virus outbreak will undoubtedly lead to less consumption of pork. The effect will be a decrease in demand for soybeans, the main food source for pigs. In 2017 total soybean exports from the US to China reached the $12.2 billion, falling to $3.1 billion in 2018 as part of the trade dispute. Phase one of the recently signed deal committed a combined import of $32 billion of additional agricultural goods for 2020 and 2021, a target that now looks to be ever more unrealistic. Given that China’s economic growth, before the outbreak, was estimated to slip to below 6 percent, concerns on this front have now increased. Some estimates are now stating that during Q1 of 2020 Chinese GDP growth may even fall below 5%. The impact from the virus and the lack of drive for trade activity from China is expected to remain a heavy counterweight for the dry bulk market. The uncertainty regarding how the situation will evolve leaves for very questionable results as to when the market will be able to rebound. The current open tonnage list in the Pacific region has already build up to unsustainable levels, a condition that is hard to shift if China doesn’t manage to take the situation under complete control”, Vamvakas concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide