State of Alaska Department of Revenue lessened its position in Brooks Automation, Inc (NASDAQ:BRKS) by 2.0% during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 54,588 shares of the semiconductor company’s stock after selling 1,109 shares during the period. State of Alaska Department of Revenue owned about 0.07% of Brooks Automation worth $2,290,000 as of its most recent SEC filing.

State of Alaska Department of Revenue lessened its position in Brooks Automation, Inc (NASDAQ:BRKS) by 2.0% during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 54,588 shares of the semiconductor company’s stock after selling 1,109 shares during the period. State of Alaska Department of Revenue owned about 0.07% of Brooks Automation worth $2,290,000 as of its most recent SEC filing.

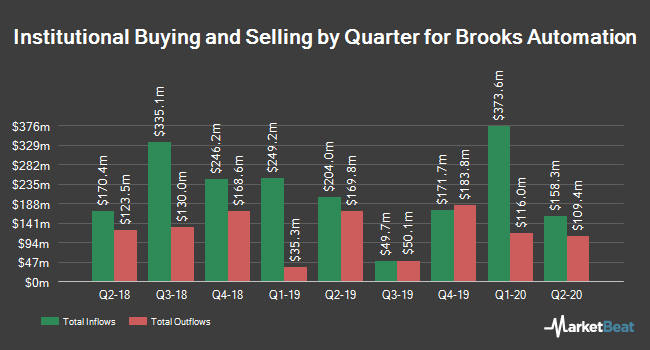

Other large investors have also recently bought and sold shares of the company. Tower Research Capital LLC TRC grew its holdings in shares of Brooks Automation by 6,038.7% in the second quarter. Tower Research Capital LLC TRC now owns 1,903 shares of the semiconductor company’s stock worth $74,000 after purchasing an additional 1,872 shares during the last quarter. Ladenburg Thalmann Financial Services Inc. increased its holdings in Brooks Automation by 213.6% during the second quarter. Ladenburg Thalmann Financial Services Inc. now owns 2,076 shares of the semiconductor company’s stock valued at $80,000 after buying an additional 1,414 shares during the period. Point72 Asset Management L.P. bought a new position in Brooks Automation in the second quarter worth approximately $81,000. Russell Investments Group Ltd. bought a new stake in shares of Brooks Automation in the 3rd quarter valued at about $101,000. Finally, Strs Ohio increased its position in shares of Brooks Automation by 8.3% during the third quarter. Strs Ohio now owns 5,200 shares of the semiconductor company’s stock worth $192,000 after purchasing an additional 400 shares in the last quarter. Hedge funds and other institutional investors own 98.53% of the company’s stock.

In other news, SVP Jason Joseph sold 6,000 shares of Brooks Automation stock in a transaction on Thursday, January 2nd. The stock was sold at an average price of $42.63, for a total value of $255,780.00. Following the completion of the sale, the senior vice president now owns 99,158 shares of the company’s stock, valued at $4,227,105.54. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider David Pietrantoni sold 4,334 shares of Brooks Automation stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $47.00, for a total value of $203,698.00. Following the completion of the sale, the insider now owns 28,101 shares of the company’s stock, valued at approximately $1,320,747. The disclosure for this sale can be found here. Insiders sold 233,337 shares of company stock valued at $10,499,089 in the last quarter. 2.66% of the stock is owned by insiders.

BRKS has been the topic of several research analyst reports. ValuEngine downgraded Brooks Automation from a “buy” rating to a “hold” rating in a research note on Tuesday, December 3rd. BidaskClub downgraded shares of Brooks Automation from a “hold” rating to a “sell” rating in a research note on Saturday. TheStreet raised Brooks Automation from a “c+” rating to a “b-” rating in a research report on Wednesday, November 6th. Finally, Zacks Investment Research cut Brooks Automation from a “buy” rating to a “hold” rating in a report on Monday. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and two have issued a buy rating to the company. The company presently has a consensus rating of “Hold” and a consensus price target of $42.60.

Shares of BRKS traded up $0.49 during trading hours on Tuesday, hitting $39.05. 255,780 shares of the stock were exchanged, compared to its average volume of 428,712. Brooks Automation, Inc has a 12-month low of $28.42 and a 12-month high of $50.35. The company has a debt-to-equity ratio of 0.04, a quick ratio of 2.01 and a current ratio of 2.38. The company has a market cap of $2.80 billion, a price-to-earnings ratio of 6.47 and a beta of 1.41. The stock’s 50-day moving average price is $41.67 and its two-hundred day moving average price is $39.53.

Brooks Automation (NASDAQ:BRKS) last issued its earnings results on Wednesday, November 6th. The semiconductor company reported $0.24 earnings per share (EPS) for the quarter, beating the Thomson Reuters’ consensus estimate of $0.23 by $0.01. The company had revenue of $200.23 million during the quarter, compared to analysts’ expectations of $195.38 million. Brooks Automation had a return on equity of 6.67% and a net margin of 55.99%. The firm’s quarterly revenue was up 25.4% on a year-over-year basis. During the same period in the prior year, the business earned $0.40 EPS. On average, research analysts expect that Brooks Automation, Inc will post 1.26 earnings per share for the current year.

Brooks Automation Company Profile

Brooks Automation, Inc provides automation and cryogenic solutions for various markets. The company operates in two segments, Brooks Semiconductor Solutions Group and Brooks Life Science Systems. The Brooks Semiconductor Solutions Group segment offers mission-critical wafer automation and contamination controls solutions and services.

Recommended Story: Why are gap-down stocks important?

Receive News & Ratings for Brooks Automation Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Brooks Automation and related companies with MarketBeat.com’s FREE daily email newsletter.