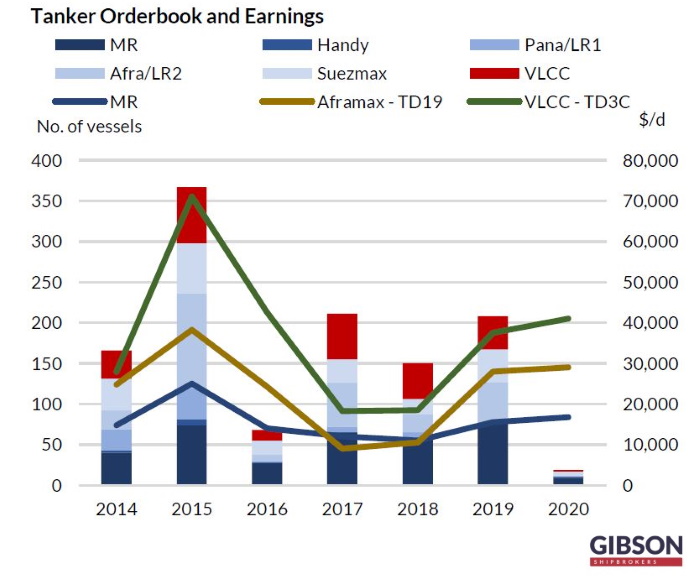

The tanker market had a positive 2019 and 2020 was shaping up to be equally good, but the latest developments with the Coronavirus and its impact on world trade could derail this estimate. In its latest weekly report, shipbroker Gibson said that “taking stock of what happened in the tanker sector during 2019 highlights that it was a positive year. Earnings across the board were up compared to 2018, with returns for VLCCs rising from an average of $18,500/day during 2018 to $37,500/day and Aframax following suit with earnings rising from $10,500/day to $28,000/day. But owners were still uncertain about the future and there was limited financing available, which had a dampening effect on owners ordering new tonnage. Overall orders for the year topped 200 tankers, an increase of 39% compared to the previous year, but still a long way behind the 360 vessels that were ordered in 2015. Owners were ordering MRs, Aframaxes/LR2s and Suezmaxes with renewed vigour, while VLCCs orders remained at similar levels to 2018 with 41 vessels”.

According to Gibson, “the orders poured into South Korea, which remains the dominate player in the newbuilding sector taking 56% of all tanker orders during 2019. Chinese yards received 62 tanker orders, while orders continue to be placed in Japan, albeit at a much lower volume when compared to historic levels, with just 18 tankers. Russia and Vietnam were the only other countries that reported orders for deepsea tankers last year. With the increase in ordering compared to the previous year, there was an up-tick in newbuilding prices with VLCC prices rising by $4 m to $92 m and Suezmax prices rising by $3 m to $62 m. These price rises come at a time when there is uncertainty in the shipbuilding world as various yards in South Korea, China, Japan and Singapore are all considering the benefits of merging. Sinokor ordered the largest number of tankers, with 10 Aframaxes, four MRs and four VLCCs during the year. The Aframaxes will be constructed at Samsung and delivered in 2021. These will be LNG powered and will be chartered to Shell. The VLCCs will be built at Daewoo, whilst the MRs will be constructed at Hyundai Mipo”.

The shipbroker noted that “the positive market sentiment that occurred throughout the majority of the year was there for most of 2019, despite the changing market environment. The Ballast Water Management Convention kicked in during September 2019, whilst at the same time, owners were looking at how they could navigate through the new IMO rules for low sulphur fuels. Towards the end of the year the transition to the new fuels was handled with little disruption to global trade”.

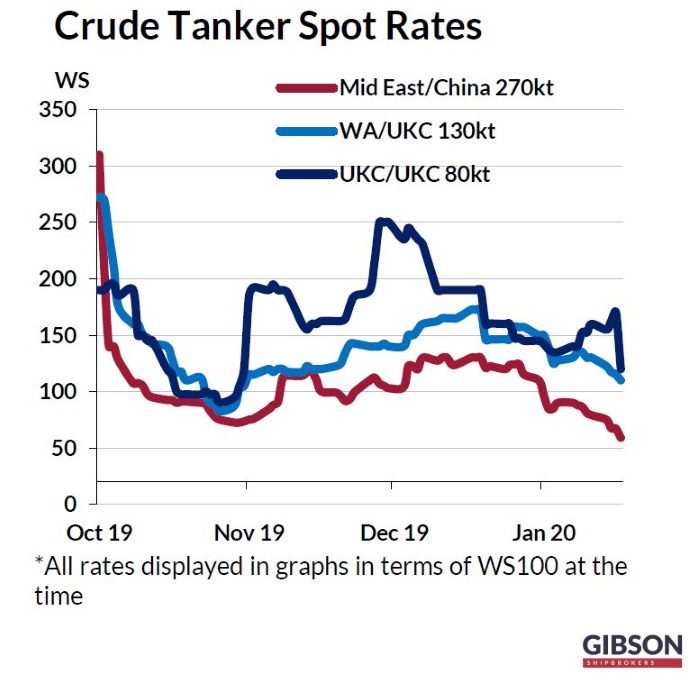

Gibson added that “so, if 2019 was a positive year, what of 2020? The fundamentals for another positive year looked to be in place with a positive reaction to the US-China phase one trade deal, where China agreed to buy $200 billion worth of US goods and services, of which $52 billion in energy purchases. This could re-open the emerging tanker trades between the two countries, with potentially positive impact for the tanker sector. But for the present all crude sectors are already recalibrating sharply lower and there are also some very dark clouds on the horizon for the tanker market. The current situation with the Coronavirus has seen many flights to China discontinued until further notice, could this also happen within the tanker sector? The re-emergence of the COSCO Dalian vessels being could be detrimental to tanker earnings going forward. Also, there is much uncertainty over decarbonisation regulations which seems to be curbing newbuilding orders. The flip side to this could be that the low volume of vessel ordering in 2019 has provided a period of controlled fleet growth, which if continued could bring better fundamentals for tanker earnings”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide