Sigma Planning Corp reduced its stake in shares of Rockwell Automation (NYSE:ROK) by 7.5% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 4,891 shares of the industrial products company’s stock after selling 396 shares during the quarter. Sigma Planning Corp’s holdings in Rockwell Automation were worth $991,000 as of its most recent filing with the SEC.

Sigma Planning Corp reduced its stake in shares of Rockwell Automation (NYSE:ROK) by 7.5% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 4,891 shares of the industrial products company’s stock after selling 396 shares during the quarter. Sigma Planning Corp’s holdings in Rockwell Automation were worth $991,000 as of its most recent filing with the SEC.

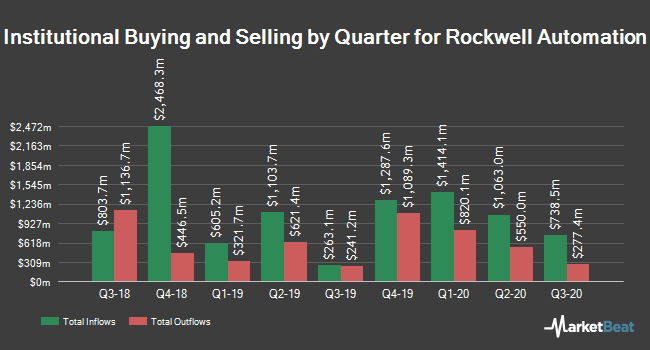

Several other large investors also recently made changes to their positions in the stock. Shine Investment Advisory Services Inc. raised its holdings in shares of Rockwell Automation by 217.2% during the 4th quarter. Shine Investment Advisory Services Inc. now owns 628 shares of the industrial products company’s stock valued at $127,000 after buying an additional 430 shares during the period. MAI Capital Management purchased a new stake in Rockwell Automation during the 4th quarter worth approximately $206,000. Quadrant Capital Group LLC increased its holdings in Rockwell Automation by 31.3% during the 4th quarter. Quadrant Capital Group LLC now owns 642 shares of the industrial products company’s stock worth $124,000 after purchasing an additional 153 shares during the last quarter. Banque Pictet & Cie SA increased its holdings in Rockwell Automation by 9.5% during the 4th quarter. Banque Pictet & Cie SA now owns 4,910 shares of the industrial products company’s stock worth $995,000 after purchasing an additional 425 shares during the last quarter. Finally, UMB Bank N A MO purchased a new stake in Rockwell Automation during the 4th quarter worth approximately $206,000. Institutional investors and hedge funds own 73.72% of the company’s stock.

In related news, CFO Patrick P. Goris sold 3,400 shares of the business’s stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $200.00, for a total transaction of $680,000.00. Following the completion of the transaction, the chief financial officer now owns 12,202 shares in the company, valued at approximately $2,440,400. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, SVP Frank C. Kulaszewicz sold 7,500 shares of the business’s stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $196.02, for a total value of $1,470,150.00. Following the transaction, the senior vice president now owns 32,931 shares of the company’s stock, valued at approximately $6,455,134.62. The disclosure for this sale can be found here. In the last quarter, insiders sold 36,950 shares of company stock valued at $7,343,119. Insiders own 0.77% of the company’s stock.

Several research firms have issued reports on ROK. TheStreet upgraded Rockwell Automation from a “c+” rating to a “b” rating in a report on Wednesday, January 29th. ValuEngine downgraded Rockwell Automation from a “buy” rating to a “hold” rating in a report on Wednesday, November 13th. Rosenblatt Securities restated a “hold” rating on shares of Rockwell Automation in a report on Wednesday, January 29th. Citigroup restated a “neutral” rating and set a $208.00 price objective (up from $174.00) on shares of Rockwell Automation in a report on Wednesday, November 13th. Finally, Morgan Stanley upgraded Rockwell Automation from an “underweight” rating to an “equal” rating in a report on Wednesday, December 11th. One investment analyst has rated the stock with a sell rating, fourteen have given a hold rating and three have given a buy rating to the company. Rockwell Automation currently has a consensus rating of “Hold” and an average price target of $192.27.

Shares of ROK opened at $202.72 on Friday. The firm has a market cap of $23.82 billion, a price-to-earnings ratio of 23.95, a PEG ratio of 2.91 and a beta of 1.46. The stock has a 50 day moving average of $201.96 and a 200-day moving average of $178.82. The company has a current ratio of 1.45, a quick ratio of 1.15 and a debt-to-equity ratio of 2.13. Rockwell Automation has a 52 week low of $143.91 and a 52 week high of $207.94.

Rockwell Automation (NYSE:ROK) last issued its earnings results on Wednesday, January 29th. The industrial products company reported $2.11 EPS for the quarter, hitting the consensus estimate of $2.11. The company had revenue of $1.68 billion during the quarter, compared to analyst estimates of $1.63 billion. Rockwell Automation had a return on equity of 102.93% and a net margin of 13.75%. The business’s revenue was up 2.6% on a year-over-year basis. During the same quarter last year, the firm earned $2.21 EPS. On average, sell-side analysts predict that Rockwell Automation will post 8.94 earnings per share for the current fiscal year.

The company also recently announced a quarterly dividend, which will be paid on Tuesday, March 10th. Stockholders of record on Tuesday, February 18th will be given a $1.02 dividend. The ex-dividend date is Friday, February 14th. This represents a $4.08 annualized dividend and a dividend yield of 2.01%. Rockwell Automation’s payout ratio is 47.06%.

Rockwell Automation Profile

Rockwell Automation, Inc provides industrial automation and information solutions worldwide. It operates in two segments, Architecture & Software; and Control Products & Solutions. The Architecture & Software segment provides control platforms, including controllers, electronic operator interface devices, electronic input/output devices, communication and networking products, and industrial computers that perform multiple control disciplines and monitoring of applications, such as discrete, batch and continuous process, drives control, motion control, and machine safety control.

Read More: How to calculate compound interest

Want to see what other hedge funds are holding ROK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Rockwell Automation (NYSE:ROK).

Receive News & Ratings for Rockwell Automation Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Rockwell Automation and related companies with MarketBeat.com’s FREE daily email newsletter.