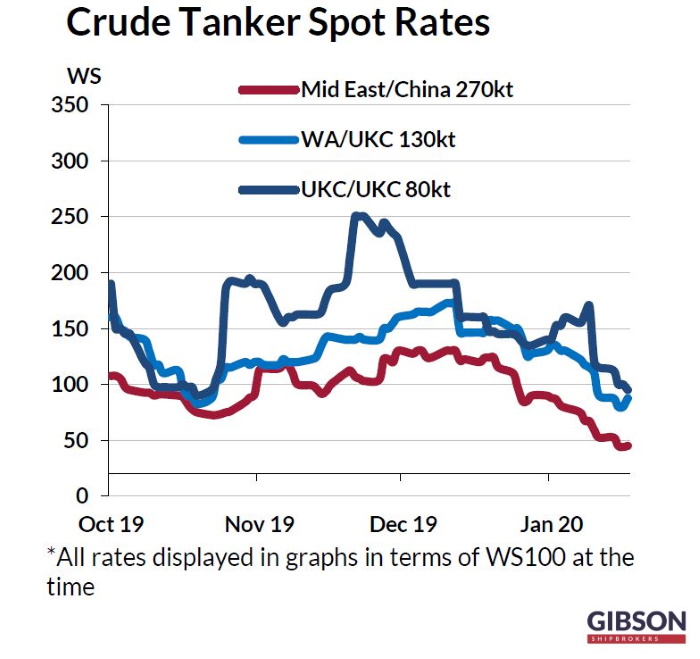

The effects of the coronavirus are soon to be felt hard in the tanker market as well, with disruptions expected to reap havoc in the wet segment’s supply chain, not to mention the scheduled drydocks and retrofittings. In its latest weekly report, shipbroker Gibson said that “just over two weeks ago China imposed a lockdown in Wuhan and other cities in Hubei province in an effort to contain the spread of the deadly coronavirus outbreak. Since then, further quarantines have been put in place, starting to cause disruptions across many global industries. Conditions in the crude tanker market have already changed beyond recognition. Currently, spot VLCC earnings on TD3C (nonscrubber) stand at just $16,000/day, compared to over $115,000/day in early January. The picture is similar for smaller size groups. The fear of coronavirus is not the only factor behind the decline in freight: the news that US sanctions were lifted on COSCO tonnage inevitably dampened the sentiment across the whole crude tanker complex”.

According to Gibson, “in terms of the coronavirus outbreak, this is what we know so far. There has been a dramatic decline in global jet fuel demand, most notably in Asia. Demand for other transportation fuels is also down, although to a lesser degree. This offered some supportto arbitrage movements out of the region as product stocks started to build, but in the longer run product trade could be impacted if further quarantines are put in place and/or weakness in demand spreads globally. Crude demand into China is also under pressure, with domestic refineries cutting runs. According to Argus estimates, Chinese refining throughputs declined by at least 840,000 b/d in January, while further cuts are widely anticipated in February. As reported by the Financial Times, executives at China’s largest refineries expect that the country’s oil consumption could fall by 25% this month, equivalent to a staggering 3.2 million b/d”.

The shipbroker added that “as China accounts for nearly 30% of growth in world oil demand this year,the spread of coronavirus could noticeably dent gains in oil consumption. Demand in other Asian countries is also under pressure. We are already seeing an impact on global manufacturing supply chains, with Hyundai halting operations at its giant car plant in Ulsan. Although the situation continues to evolve rapidly, attempts have been made to estimate the impact on global oil consumption. BP suggested that demand could decline by 300,000 – 500,000 b/d in 2020 and broadly similar views were expressed by other analysts. Not surprisingly, we have seen a decline in oil prices and a rising contango in crude futures. Potentially, crude tanker floating storage could emerge, although a lot here depends on OPEC+ action, with the technical committee recommending a 600,000 b/d cut”.

“The outbreak could also translate into all sorts of logistical hurdles. Although not seen so far, port delays could emerge. It is already becoming problematic to arrange SIRE inspections in Asia, while crew management could also be challenging, considering that China is one of the world’s largest seafaring nations. Drydocking, scrubber and Ballast Water Treatment system retrofits in China are getting delayed due to yard closures. However, this also means that vessels that are scheduled for inspections and/or retrofits soon will be unable to do so and may continue trading, if classification societies grant extensions. The picture is different for new tanker deliveries, with shipyards declaring force majeure over delays to newbuildings under construction. This year 64 tankers over 25,000 dwt, including 14 VLCCs are due for delivery from Chinese yards”, Gibson said.

“The above is what we know but there are plenty of unknowns, most critically how long the outbreak will last and how far it will spread. Without a doubt, the longer the duration, the bigger the implications are. For now, we are not even close to approaching the end of this epidemic”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide