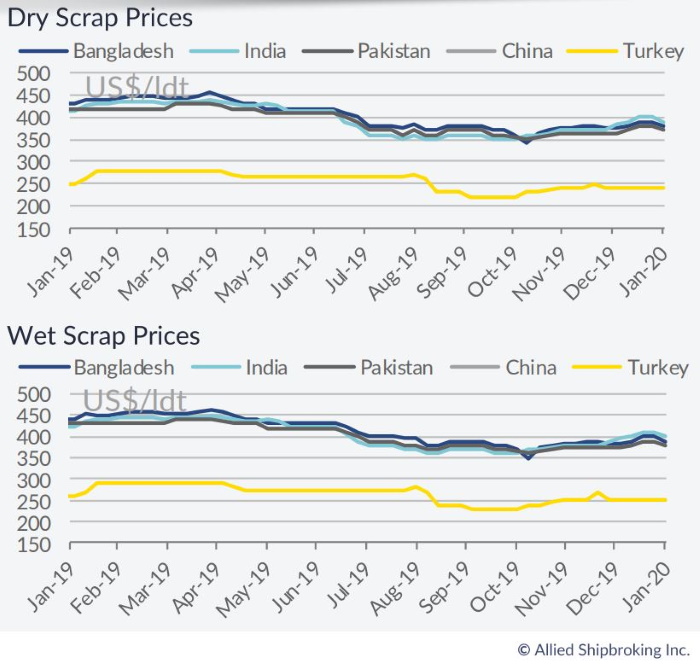

Amidst a major crisis like the current one, with most of China under lock-down, the shipping industry has a solid opportunity to accelerate the decommissioning of a significant number of older vessels. And as it turns out, this has been the case so far. In its latest weekly report, shipbroker Allied Shipbroking noted that “a state of imbalance in the ship recycling market seems to have been due at this point. The dry bulk sector started on the wrong foot from the very start of the year, with the scene in the freight market being a picture of complete disarray and freight earnings reach in some cases all time lows. Given this, an excessive tonnage capacity has been pushed towards the demolition market over the past few days, with breakers seemingly looking to accommodate as much tonnage as possible. As a result, offered numbers have eased back below the US$ 400/Ldt mark, while, at the same time, the prevailing attitude amongst the main buyers is “passive”, waiting on how things may evolve in the near term. More specifically, the Bangladesh market looks to already be preoccupied with processing its current inventory (with steel plate prices noting a fair correction of late). India has also witness further corrections both as part of the unfavorable movements in its local currency and steel plates. Finally, Pakistani breakers still seem to be lagging behind the other two main destinations in the Indian Sub-Continent, seemingly unwilling and unable to take up the current market opportunity and secure a better share of the tonnage circulated in the market”, said the shipbroker.

In a separate note, shipbroker Clarkson Platou Hellas said that “what goes up, usually comes down. And sadly this appears to be the case in Bangladesh this week as the large number of definite or potential candidates being touted in the market looks to have taken its toll as confidence ebbs away and cash buyers adopt a cautious (less adventurous) approach when offering as reportedly, they have found it difficult to attract positive numbers from the local recyclers at Chattogram. It would therefore seem that the recyclers in Bangladesh are now fearful of having to absorb the large quantity of the VLOC/capesize bulk carriers that have surfaced in the market, on the back of further diminishing freight rates affecting these trades. The main recyclers in Chattogram are also reportedly having difficulties opening up their Letters of Credit in light of the recent acquisitions of the larger dry units which may also reflect the current difficulties in Bangladesh and correction in price levels. Whilst the basic fundamentals of the market have not changed, there has been so much gossip overflowing in the industry relating to the potential dry candidates that will arrive which has resulted in uncertainty encroaching the sentiment and ensuring a correction downwards in price levels. However, we do not wish to paint a poor picture of the overall market. What has really happened is that the Bangladeshi rates have now fallen closer to those on offer from their counterparts in India and Pakistan where these destinations remain stable with positive demand to acquire units. Now with the Bangladeshi levels having weakened towards those on offer from India and Pakistan, we may see tonnage being diverted towards these shores which will be a positive scenario. Despite a lot of activity being reported this week, there have so far been no sales concluded”.

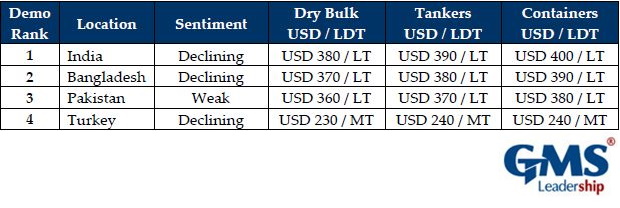

Meanwhile, GMS, the world’s leading cash buyer of ships said this past week that “international uncertainties have seeped through to the recycling markets this week as some dramatic reversals in both sentiments and pricing rocked the industry, leaving Cash Buyers who have bought some expensive tonnage and Ship Owners with fresh vessels to sell, suddenly find themselves chasing down the market. Dry bulk rates have been risible at the start of the year, but that has not yet translated to a deluge of incoming vessels for recycling – perhaps due to a sluggish start with Chinese New Year holidays at the end of January (now extended until February 9 due to the ongoing Coronavirus outbreak) and Ship Owners now waiting to see whether a bounce back would occur upon the conclusion of the holidays.

However, this week, we really started to see a plethora of candidates hit the market and this has begun to put further pressure on prices that are already starting to tumble. About 10 Capesize Bulkers and VLOCs are being touted for sale in the coming weeks / months and Bangladesh (traditionally buyers of larger LDT tonnage) will certainly not be able to absorb anywhere near all of this tonnage – given that capable and performing End Buyers with workable bank / L/C limits are already starting to dwindle. Therefore, some of the onus will start to fall on India and Pakistan to lift the burden – albeit at lower numbers that are back below USD 400/LT LDT again and sentiments in these two markets is also starting to creak off the back of failing fundamentals. From the Cash Buyer’s point of view, it may therefore be a case of waiting and watching rather than jumping in on fresh tonnage as rates fall – turning today’s market price deals into tomorrow’s losing ones”, GMS concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide