mStable – a rising liquidity aggregator – has debuted their Earn feature, granting liquidity providers real-time MTA rewards.

Today, mStable introduces EARN: a hub that allows you to stream & keep track of your MTA rewards in real time.

Get started: https://t.co/aLx10Xe7wl

Learn more: https://t.co/LGj2pjfyyV

— mStable 🧮 (@mstable_) August 3, 2021

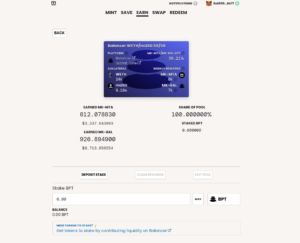

After roughly a month of liquidity incentives on Balancer, mStable has ported their MTA governance token distribution away from snapshots to an automated, yield tracking dashboard via their Earn feature.

Consisting of five different reward pools, mStable will adjust weekly allocations relative to where ecosystem liquidity is the most useful at any given time. For the first week, 100,000 MTA will be allocated as follows:

Sneaking its way into the incentive program is the MTA/ETH Uniswap pool – debatably the most crucial piece of liquidity for the sector’s hottest DeFi token. Seeing as Balancer provided a more modular liquidity onramp, it should come as no surprise that now that a strong base has been established, porting incentives to the fan-favorite DEX in Uniswap is the logical next step.

What’s To Know?

The biggest component of Earn is the necessity for LP’s to stake their liquidity tokens via the Earn dashboard. This notion is a new upgrade to MTA liquidity mining in which rewards were previously manually airdropped by simply being in the pool when random snapshots were taken throughout the course of the week.

To this note, it seems like some LPs have yet to take note of the change as illustrated in this tweet by yieldfarming.info founder Weeb McGee (yes that’s high legal birthname I checked).

Yo if you’ve been farming MTA the last couple weeks you gotta stake them now.

Currently $24 million worth BPT just sitting in people’s wallets, not farming that MTA rewards. @mstable_ pic.twitter.com/GUMEBIh3zS

— weeb (@Weeb_Mcgee) August 4, 2021

The launch of Earn foreshadows the launch of MTA staking and mStable governance, two crucial pieces of the puzzle that are set to solidify mStable as a leading contender in the rising stablecoin liquidity wars.

It’s important to remember that for more conservative farmers, mStable also offers a Save feature in which users can stake mUSD for an estimated 30% APY at the time of writing.

Liquidity Mining Heats Up

As if it wasn’t obvious enough, just about every major DeFi token is now offering some sort of incentive for those providing value-added actions to their ecosystem. While driving deep liquidity on DEXs seems like the obvious first answer, it will be interesting to watch how the conversation evolves in the coming months.

Stated another way, projects which fail to incentivize liquidity are at the whims of projects offering double, and sometimes triple digital returns.

Best exemplified by Bancor and the launch of their V2 pools last week, liquidity is becoming far more rewarding across the wider DeFi ecosystem, a trend which isn’t likely to slow down anytime soon.

To add a somber note, I’m curious to watch incentives emerge which require specialized participation. Whether it be through the curation of protocol-specific assets or the ability to stake as a signal to earning opportunities, I’m forever curious about programs that incentivize knowledge over capital.

Alas, the launch of Earn is one of the more notable and well-designed liquidity mining features we’ve seen, and one you should definitely check out if you fancy yourself to be a yield farmer.

In the meantime, be sure to stay up with mStable on Twitter or by joining the conversation on Discord.

Cooper is the Editor of DeFi Rate and a contributor to leading DeFi outlets like the Defiant and Bankless. He is active in the DAO ecosystem through projects like MetaCartel and Raid Guild where he seeks to incubate governance models and grassroots community development. He is an ambassador of Set Protocol and the Director of Fitzner Blockchain Consulting where he authors a weekly publication called Token Tuesdays. To stay up with Cooper, follow him on Twitter.