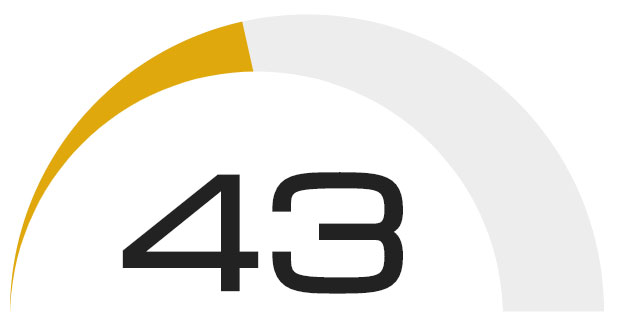

Hollysys Automation Technologies Ltd (HOLI) stock is lower by -25.06% over the last 12 months, and the average rating from Wall Street analysts is a Strong Buy. InvestorsObserver’s proprietary scoring system, gives HOLI stock a score of 43 out of a possible 100.

That score is mainly influenced by a short-term technical score of 13. HOLI’s score also includes a long-term technical score of 36. The fundamental score for HOLI is 80. In addition to the average rating from Wall Street analysts, HOLI stock has a mean target price of 26.9. This means analysts expect the stock to rise 78.50% over the next 12 months.

What’s Happening with HOLI Stock Today

Hollysys Automation Technologies Ltd (HOLI) stock is up 0.13% while the S&P 500 is up 0.54% as of 3:33 PM on Monday, Feb 10. HOLI is up $0.02 from the previous closing price of $15.05 on volume of 174,138 shares. Over the past year the S&P 500 has risen 23.47% while HOLI is lower by -25.06%. HOLI earned $2.09 a per share in the over the last 12 months, giving it a price-to-earnings ratio of 7.21.

Click Here to get the full Stock Score Report on Hollysys Automation Technologies Ltd (HOLI) Stock.