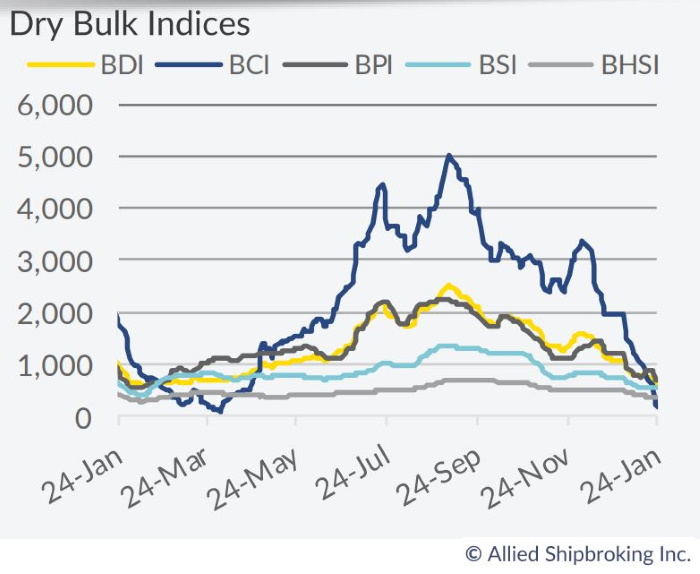

The dry bulk market is looking set for a rough ride during 2020, with spikes in rates being the exception, instead of the norm. In its latest weekly report, shipbroker Allied Shipbroking noted that “sometimes numbers can better reflect the state of the market than anything you could put into words. The BDI hit a new low of 557 basis points, reaching, at the same time, a territory that we haven’t seen since the earliest part of 2016. In order not to overdramatize this current market state, it is fair to point out that we have seen a similar scene unfold during Chinese New Year festivities over the past couple of years. Last year we also had the combo effect of the Vale incident during roughly the same time, something that hit harshly the bigger size segment and subsequently the overall dry bulk sector”.

“However, given that presently we haven’t faced any similar tail risk event, where any market exaggeration would be a logic outcome (as happened last year), could we be seeing more underlining issues playing their part or is the existing trajectory excused merely as part of typical seasonality flows. Without sounding over pessimistic, there are some “trends” (or indicators) in the market that are to say the least worrying. The asymmetrical distribution of returns (excessive periodical negative skewness) for example, is becoming more and more intense. To be fair, in the general business world, hefty downward corrections are much more prone to take place rather than upward ones. Notwithstanding this, the easiness with which the freight market has collapsed (especially for the Capesize segment), is fairly problematic“, said Mr. Thomas Chasapis, Research Analyst with Allied Shipbroking.

He added that “from the beginning of the previous month, where the overall trend in the Capesize market changed to negative, it took more or less 30 consecutive closing days in the BCI 5TC average to lose more than 80% of its value. On the other hand, on the opposite side of the seasonal market swing, it took at least 3 months since the bottoming out in April of 2019 to see a similar increase take shape. So, given the amount of time that it takes the market to recover both in terms of sentiment and actual returns, we almost seem to be “glued” to a perpetual state of mediocre average annual returns. To sum up, every year, amidst the Chinese New Year, the slowdown in freight rates is a fact. But it is one thing to discuss a seasonal effect and whole other to note a general deterioration in earnings as a whole”, Allied’s analyst said.

According to Chasapis, “all-in-all, what is left for the dry bulk sector when this “periodical” effect has faded away? Personally, I think that the current problems witnessed in the market have far deeper origins than the periodical disruptive dynamics of late. For the time being, the overall uncertainty in bunker prices will add further pressure to the side of realized earnings. Moreover, the uninspiring potential macroeconomic growth (despite the admirable adaptation seen from the supply side of things) will only point to the fact that the shipping industry as a whole may well be stuck in a state of plain-vanilla returns in line with what we have been seeing during the past few years or so. This strong deduction is actually something that has been “shouting” in the paper market for some time now, with FFA contracts of long-term expiration noting an excessive “discount”. Notwithstanding this and while taking the relatively good pulse for forward sentiment taken from current asset price levels, which haven’t experienced the massive correction that might be expected-given the current freight rate environment, adds a glimpse of hope of better times to come in the near term or so. With all that being said and given the recent trends and the positive spikes that emerge from time to time, market participants should be on alert to any sharp shifts in the market that may create any small windows of opportunities, that could be the true answer to how to maximize returns for the year”, he concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide