Plenty of ships were sold for scrap over the past week, however, as rates for both the dry bulk and the container markets soared, demolition candidates are bound to diminish in numbers. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “with the Golden Week holiday period taking place this week, it has felt like the market has stalled for the time being with very little activity taking place. This, coupled with the ever developing Covid-19 situation, working environments are far from normal with the ongoing disruption continuing leading to a distinct lack of market discussion amongst stakeholders in the industry. When will we ever return to normality?

Plenty of ships were sold for scrap over the past week, however, as rates for both the dry bulk and the container markets soared, demolition candidates are bound to diminish in numbers. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “with the Golden Week holiday period taking place this week, it has felt like the market has stalled for the time being with very little activity taking place. This, coupled with the ever developing Covid-19 situation, working environments are far from normal with the ongoing disruption continuing leading to a distinct lack of market discussion amongst stakeholders in the industry. When will we ever return to normality?

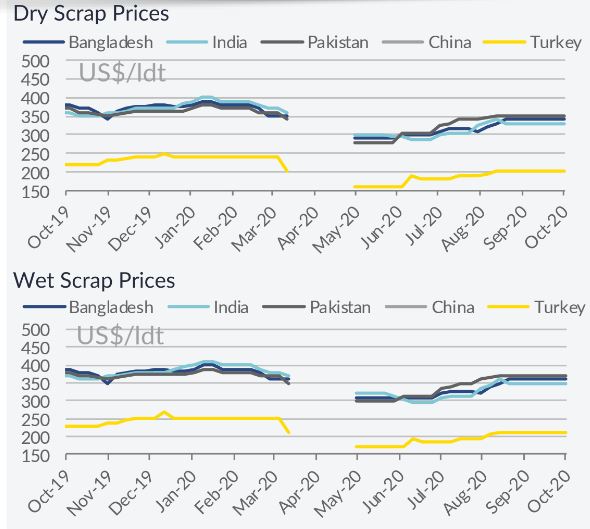

According to Clarkson Platou Hellas, “many have now come to the realisation that there are very few ships in the market and this looks set to continue until the end of the year with the firming freight rates diverting Owners attention away from the recycling market. One positive note to take on board however, is that despite global stock markets showing a large amount of volatility due these uncertain times, local steel markets continue to remain firm and price levels for ships have held strong over the past month in India and Pakistan. In Bangladesh, the recently formed Cartel remains in place preventing vessels being re-sold locally above an agreed threshold (as indicated last week). It will be interesting to watch how this develops if the market is further starved of tonnage and domestic recyclers become desperate to acquire units. This week, the cartel has been instrumental in the sale of two smaller vessels with the price agreed in the region of USD 345/ldt. There are reports of a VLOC being sold ‘as-is’ Labuan but at the reported price, it is highly unlikely the vessel has been acquired with a resale to Bangladesh in mind, as rumours suggest the cartel placed a price limit of USD 350/ldt on the unit, therefore most likely the vessel will be destined for Pakistan”, the shipbroker concluded.

In a separate note this week, Allied Shipbroking said that “an improved week in terms of tonnage volume being sold for demolition, as surging prices helped owners of vintage units to take the decision to retire some of their current vessels. We expect the activity in the demolition market to continue on at moderate levels at least, as uninspiring freight markets (especially in the tanker market) and current offered price levels are making scrapping an attractive option. In Bangladesh, the recently shaped cartel by breakers has limited the competition within the country but ramped up the rivalry with the rest of Indian Sub-Continent countries. Demand in the country remained robust, due to attractive offered prices and healthy fundamentals. In India, the ongoing crisis with COVID-19 has had an impact on the demolition market as well, decreasing interest from the side of end-buyers, as well as the costs of the local scrapyards that are unable to compete with Bangladesh and Pakistan. In the case of the latter, the new era that began as of late with very competitive prices seems to still hold durability, as more and more owners are choosing Pakistan for the recycling of their fleet”, Allied said.

In a separate report this week, GMS (http://www.gmsinc.net/), the world’s leading cash buyer of ships, said that “after a period of turbulence and uncertainty, Indian subcontinent sentiments and prices appear to have turned somewhat this week, as Cash Buyer speculation seems to have re-entered the market on select available vessels once again. A slowdown in supply may have contributed to this turn in sentiment, with a marked decrease in the number of suitable candidates available for demo. Dry bulk rates (particularly for Capes) have started to soar again of late and containers have picked up as well, thereby depriving recycling destinations of a steady supply of units that they have seen for a majority of this year. Furthermore, uncertainty still reigns on feasible ‘as is’ take over locations, with varying quarantine periods for arriving crews and outright rejection of deliveries still being reported in numerous (previously accessible) destinations. The formation of a cartel to try and control prices in Bangladesh and the filling of many plots in Pakistan has seen prices start to cool off over the previous few weeks, but now an element of buoyancy seems to have returned as markets remain somewhat starved for tonnage.

India has had to make do with a relatively meagre supply of HKC green tonnage, despite several more PCC vessels being sold from the Japanese market this week, for class NK HKC only recycling”, GMS concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide