As computing

power increases, the workforce in developed countries ages, and companies

strive to increase productivity and lower costs, investment in robotics,

automation and artificial intelligence is surging. These technologies are disrupting

industries in almost every geography, creating a swift transition to an “automate

or fail” economy.

These are

megatrends that increasingly impact our daily lives. We can’t stop the

train…but as investors, can we jump on board?

Two

innovative issuers have made this possible through the development of ASX

quoted exchange traded funds or ETFs. Importantly, they are not your typical

ETF that slavishly tracks an established benchmark index such as the

S&P/ASX 200. Rather, they are thematic ETFs, and while they track an index,

it is a constructed index put together by a research firm. They boast the same

advantages as regular ETFs - relatively low management fees, easy access to buy

or sell units on the ASX, and transparency around pricing and holdings. However,

it is the constructed index that is the difference.

ETF

Securities has the ETFS ROBO Global Robotics and Automation ETF. Trading under

the ASX ticker ROBO, the fund invests in companies in the robotics, automation

and AI fields.

ROBO Global,

a US research firm specialising in this area, puts the index together. It

consists of 87 companies, comprising 25 “‘bellwether” companies (established

leading players whose core business is directly related to robotics and

automation) and 62 “non-bellwether” companies

(companies with a distinct proportion of their business in robotics and

automation that have potential to grow through innovation and market adoption

of their products and services). US companies top the list (approx. 45% by

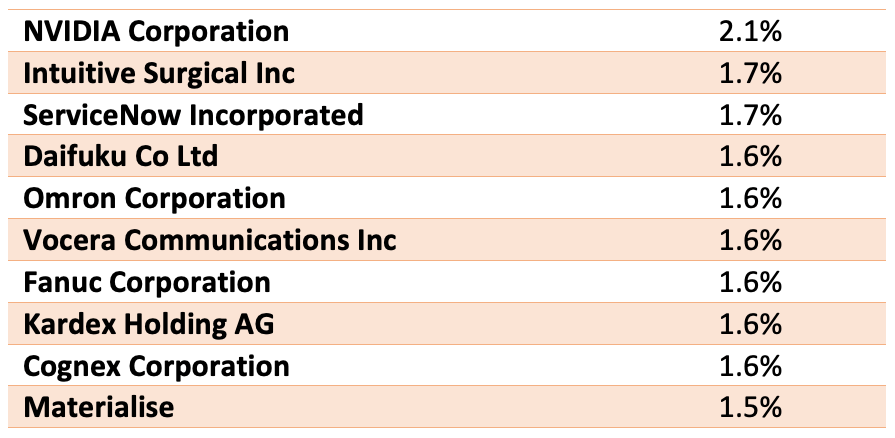

weight), followed by Japan at 19% and Germany at 7%. The current top 10 holdings

are set out below.

ROBO – Top 10 holdings at 15 September 2021

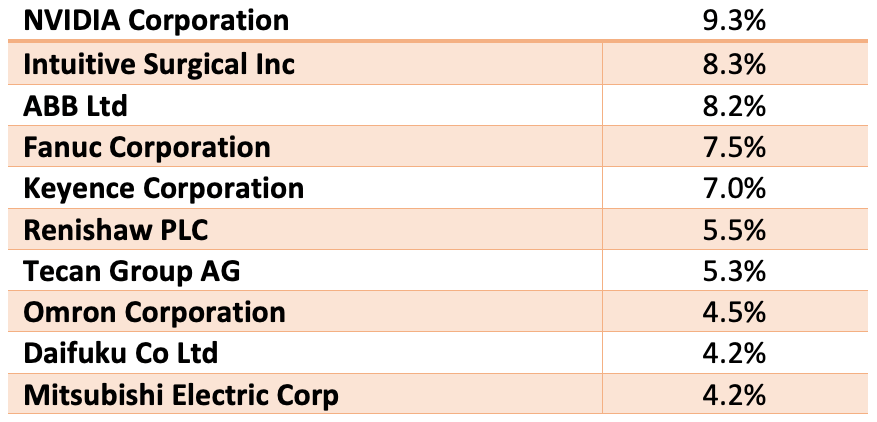

BetasShares Global

Robotics and Artificial Intelligence ETF (ASX: RBTZ) tracks an index that

follows companies involved in industrial robotics and automation, non-industrial

robotics, unmanned vehicles and drones, and artificial intelligence.

Put together

by Indxx (another US research firm), the index catches top “pure play” robotics

and AI companies by market capitalisation. Currently comprising 31 companies, no

company can be more than 8% of the index (when rebalanced) or less than 0.3%.

Interestingly, Japanese companies currently comprise 42% of the fund, compared

to 35% from the USA.

RBTZ – Top 10 holdings at 14 September 2021

There is

quite a degree of similarity in the top 10 holdings of each ETF, although RBTZ

is more concentrated. Graphics processing unit designer and AI firm NVIDIA has

a 9.3% weighting in RBTZ, but only a 2.1% weighting in ROBO.

Performance

and Fees

For ROBO,

ETF Securities charges a management fee of 0.69% pa. Betashares charges 0.57%

pa for RBTZ.

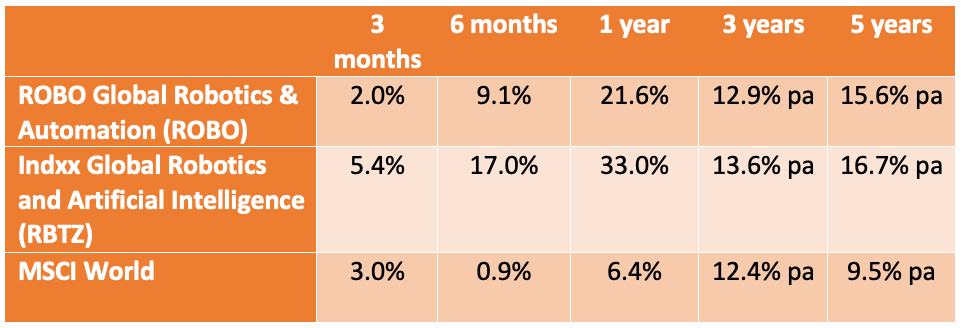

Performance

of the underlying indices (and a benchmark for global equity markets, the MSCI

World) are set out in the table below.

Performance to 31 August 2021 (in

Australian Dollars)

Both indices

(and their corresponding ETFs) have performed well, outperforming the benchmark

global equity index over the last 5 years. The index that BetaShares uses for

RBTZ (Indxx Global Robotics and Artificial Intelligence) has performed very

strongly over recent periods.

Which

one?

Despite RBTZ topping ROBO for performance, I prefer ROBO because the index it tracks is broader with more companies. It tries to pick up (through the “non-bellwether component”) companies that have the potential for rapid growth through innovation or the market adopting their products and services. But on current data, there isn’t that much to choose between the two ETFs. Either should allow you to access the megatrends of robotics, automation and AI.